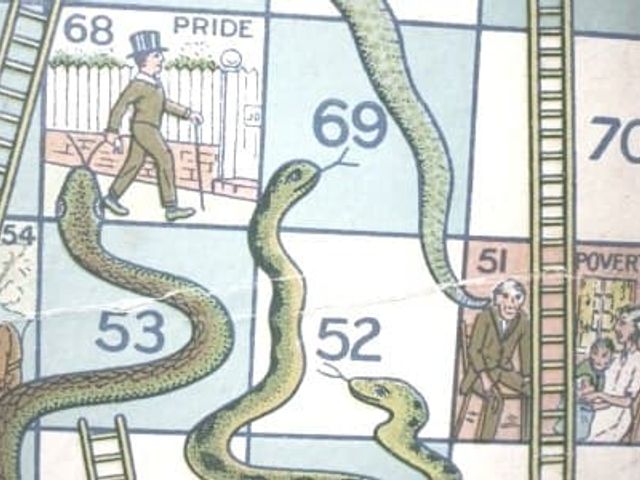

SNAKES & LADDERS' OF AR AGREEMENTS.

Published on Nov 14, 2013

(Or things I wish I had known to avoid a messy departure from my dealer group...)

An unexpected by-product of the FOFA reforms has been an increase in the problems experienced by ARs wanting to move dealer groups. Presumably desperate to retain grandfathered remuneration entitlements, some unscrupulous licensees are using their AR Agreements as a ‘retention strategy’.

The ‘Snakes’

Draconian clauses in the AR Agreement provide a neat way to interfere with advisers’ ability to exit.

Some nasty examples we have seen include:

- Penalty provisions imposing exorbitant charges for bulk transfers of clients.

- ‘Sale’ provisions requiring the adviser to pay market price for their own clients.

- Unnecessarily long transfer periods (e.g. 90 days) - which add to the ‘termination notice period’.

- Keeping commissions if the clients are not transferred within a certain timeframe – with no extension if the licensee causes the delay.

- Requiring clients to be offered the opportunity to stay with the outgoing licensee.

- Withholding consent to transfer while ‘compliance’ issues are outstanding.

The ‘Ladders’

The sheer audacity of licensees who use the exit process as a ‘leg up’ or an opportunity to improve their legal position!

For example, requiring the incoming licensee to sign a “Transfer Deed” that requires them to:

- Review all clients within a short time period – this simply isn’t necessary for advisers who have ongoing fee arrangements with clients as the new licensee becomes liable for the adviser’s ongoing acts and omissions as soon as they sign on.

- Accept legal liability for advice that was given under the outgoing AFS licence – this ‘contractually assumed’ liability won’t be covered by the incoming licensee’s PI insurance.

Transfer Deeds are a good way to manage the transition, but they need to be fair to all parties.

The Solution

Don’t just accept the AR Agreement terms – carefully check any clauses relating to:

- Terminating the agreement

- Transferring clients

- ‘Ownership’ of client data and the right to service clients – look out for ‘first rights of refusal’ or a ‘part equity ownership’ of your portfolio by the dealer group.

Better still; get some legal advice before you enter into the AR Agreement. It will be cheaper than the battle you could have when you exit.

If you have any concerns about any of these issues, please contact us.

Author: Charmian Holmes

November 2013